You know how two people can earn strong salaries and still get completely different outcomes on a loan decision? With bad credit loans, income helps, but the lender is really pricing risk, and your credit report is how they measure it.

If your score is poor because of older mistakes, or because your file is thin, you may still have options. You just need to understand what lenders look at, and how to present your affordability clearly.

In this guide, I’ll explain how UK lenders weigh income and credit history, run through secured loans, guarantor loans, short-term borrowing and bad credit mortgages, then give you practical steps to improve your credit record and reduce your interest rate.

Key Takeaways

- High income can improve affordability, but adverse credit usually means tighter checks, smaller limits, and higher interest rates.

- Specialist lending exists, including secured loans and some bad credit mortgage routes, but you must understand the risks, especially where your home is collateral.

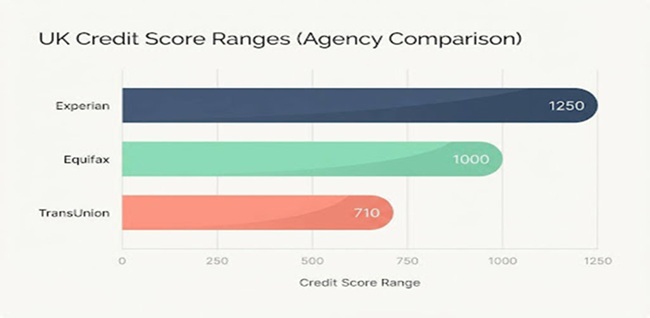

- Check all three credit reference agencies (Experian, Equifax, TransUnion), fix errors quickly, and register on the electoral roll to strengthen your file.

- Rebuild in a measured way with on-time repayments, low credit utilisation, and fewer hard searches, before you apply for a larger personal loan or mortgage.

Understanding Bad Credit

In the UK, “bad credit” is less about one magic number and more about what your credit report shows: missed payments, defaults, County Court Judgments (CCJs), insolvency markers, and patterns that suggest repayments might be a stretch.

Credit reference agencies such as Experian, Equifax and TransUnion collect data from lenders and public records, then lenders run their own credit checks and internal scoring models on top.

One detail many people miss is that the score range is not universal. Experian expanded its consumer score range to 0 to 1250 in a 2025 update, so a number that looks “good” on one app may not line up neatly with another.

| Credit reference agency | Current score range (UK) | Typical “poor” band | How to use it |

|---|---|---|---|

| Experian | 0 to 1250 | 0 to 640 | Use it for trend, then read the report details line-by-line. |

| Equifax | 0 to 1000 | 0 to 438 | Great for spotting address and account reporting issues. |

| TransUnion | 0 to 710 | 0 to 565 | Helpful for checking searches, associations, and account status updates. |

What is considered a bad credit score?

A “bad” or “adverse” score usually means your report contains recent negative markers, or you have too little history for lenders to judge you confidently.

It often comes down to recency. A problem from five years ago is usually easier to work around than one from the last few months, even if your income is high.

Government guidance on CCJs is clear: a County Court Judgment stays on the public register for 6 years unless you pay it in full within one calendar month, in which case you can have it removed from the register.

- Recent missed payments (especially repeated ones) tell lenders your budget may be under strain.

- Defaults signal a breakdown in repayment, even if you later catch up.

- CCJs and insolvency markers can push you into specialist lending or require a larger deposit on mortgages.

- Thin credit history (common if you are new to the UK) can look risky even with no “bad” events.

Your score is a signpost. Lenders decide using the detail on your credit report, plus your income and outgoings.

Factors that contribute to bad credit

Bad credit usually has a handful of repeating causes. The good news is that most of them are fixable, and lenders often respond quickly to a clear improvement trend.

- Late or missed repayments on credit cards, loans or bills can remain visible for years and reduce your borrowing options.

- Defaults on credit card and unsecured loan accounts raise the risk profile of future loan applications.

- CCJs, bankruptcy and IVAs make both mortgages and unsecured personal loans harder to access.

- Too many applications close together can hurt you twice: hard searches show up on your report, and repeated “credit seeking” makes lenders cautious.

- Payday loans and high-cost short-term credit can be a red flag for mainstream lenders, even if you repay them.

- Identity theft and reporting errors can quietly drag your score down until you dispute and correct them.

A practical safeguard if you suspect fraud is Protective Registration, a paid service run by Cifas that adds extra checks when someone tries to open credit in your name.

Can High Income Offset Bad Credit?

High income can help you pass affordability checks, but it does not “cancel out” adverse credit. In practice, lenders use income to decide what you can afford, and use your credit history to decide whether they trust you to repay.

If you want a real-world benchmark, Asda Money currently advertises personal loans up to £25,000 over 1 to 7 years with a representative 29.2% APR shown on its eligibility checker. That gives you a sense of the pricing you might see when credit is weaker.

The role of income in loan approvals

Lenders typically start with affordability: your net income, your committed outgoings, and how stable your income looks month to month.

The Financial Conduct Authority’s consumer credit rules require lenders to assess creditworthiness, including your ability to make repayments as they fall due, before entering a regulated credit agreement.

To make a high-income application easier to underwrite, prepare proof that matches how you are paid:

- Employed: recent payslips and a contract if you have changed jobs.

- Self-employed or director: tax calculations and accounts that show a consistent 12-month picture.

- Bonus, commission, overtime: evidence that it is regular, not a one-off spike.

- Universal Credit or other benefits: award letters and bank statement lines that show reliable payment.

Also be deliberate about timing. An eligibility check is often a soft search, but a full application is usually a hard search, and too many hard checks close together can make your credit file look frantic.

Balancing income and credit history

Think of it as a balancing act between three numbers: your income, your existing debts, and the monthly repayment the lender is proposing.

If your credit history is poor, lenders may still say yes, but with tighter limits, a higher interest rate, or requirements such as collateral or a guarantor.

If you need to borrow, focus on the “stress test” that matters most: could you still meet repayments if your costs rise or your income dips for a month?

High income can open doors, but your credit record decides which doors, and at what price.

Types of Bad Credit Loans Available for Bad Credit Borrowers

With bad credit, the product you choose matters as much as the lender. Your aim is to borrow at a cost you can sustain, without adding risk you cannot control.

| Option | Best for | Main trade-off | What to check before you apply |

|---|---|---|---|

| Unsecured personal loan | Smaller, defined borrowing | Higher rates with poor credit | Total cost, early settlement terms, whether the quote is soft-search |

| Secured loan (homeowner) | Larger amounts, debt consolidation | Home is at risk if you miss repayments | Fees, variable vs fixed rate, term length, repossession risk |

| Guarantor loan | When credit is weak but support is available | Guarantor takes legal responsibility | Guarantor affordability, what happens if you miss a payment |

| Short-term / high-cost credit | Last-resort emergencies | High cost and repayment pressure | Repayment date, default fees, rollover rules |

| Credit union loan | Smaller borrowing with fairer pricing | Membership and limits vary | Eligibility, term, how quickly funds can be released |

Secured loans

A secured loan uses an asset (most often your home) as collateral. This reduces the lender’s risk, so it can be easier to access than an unsecured loan when your credit score is poor.

MoneyHelper highlights the core trade-off: you may be able to borrow more than with unsecured borrowing, but you could lose the asset if you cannot keep up with repayments.

- Use a secured loan only if the repayment is comfortably affordable, even in a tougher month.

- Ask about fees (arrangement fees can materially change the APR).

- Watch term length: longer terms can lower monthly repayments, but often increase total interest paid.

Guarantor loans

A guarantor loan means someone else (usually a family member) agrees to repay if you do not. It can unlock approval when your own credit history would fail a standard credit check.

This market has changed. One of the biggest UK guarantor loan brands, Amigo Loans, closed and is no longer offering new lending, so you may find fewer mainstream guarantor loan options than a few years ago.

If you are considering a guarantor loan, treat it like a shared financial commitment, not a formality:

- Make sure the guarantor can afford repayments without risking their own bills and debts.

- Confirm exactly when the guarantor becomes liable (some agreements trigger quickly after a missed payment).

- Agree a plan in advance for what happens if your income drops or your costs rise.

Short-term loans

Short-term loans can look convenient, but they often create the highest repayment pressure, because you are compressing the whole debt into a few months.

The FCA’s price cap for high-cost short-term credit limits interest and fees to 0.8% per day, caps default fees at £15, and caps total cost at 100% of the amount borrowed. Even with that cap, these products can still be expensive and unforgiving if you need longer to repay.

If you are using short-term credit, plan your exit first: know the exact repayment date, and avoid rolling the balance into a new loan.

Bad credit mortgages and buy to let mortgages

Mortgages are a different underwriting world. Mortgage lenders will usually look closely at your recent bank statements, your deposit, and the story behind any adverse credit.

Experian’s guidance on bad credit mortgages notes that you may be asked for a larger deposit, often 20% to 25% rather than the 5% to 10% you see on many mainstream deals.

If you are looking at buy to let mortgages, affordability often depends on rent “stress tests”. In many cases lenders look for rental income coverage in the 125% to 145% range, which can tighten sharply if interest rates rise.

This is where good mortgage advisors and experienced mortgage brokers earn their keep. Many specialist lenders do not take direct applications, and a broker can help you avoid multiple failed mortgage applications that leave hard searches behind.

Tips for Improving Your Loan Eligibility

If you want better rates, you need to make the lender’s job easy: reduce risk signals, improve affordability, and show consistent repayment behaviour.

Reducing existing debt

Start with the debt that is costing you the most. High-interest credit cards and overdrafts can eat disposable income, which is exactly what lenders test in affordability checks.

If you are consolidating, treat the new loan as a reset, not extra borrowing. The only real win is when the total monthly burden becomes easier to manage, and you stop revolving balances.

For your credit score, credit utilisation matters. Experian’s guidance is to keep utilisation below 30% if possible, because high utilisation can signal reliance on credit even when your income is strong.

- List all debts with balance, rate of interest, and minimum repayment.

- Overpay the highest rate first, while keeping minimum repayments elsewhere.

- If you consolidate, stop using the cards you just paid down, or you can end up with two problems.

Checking your credit report for errors

Check your credit report with all three agencies before you apply. Errors like the wrong address, duplicated accounts, or an out-of-date balance can be enough to tip a marginal decision into a decline.

As a practical routine, review your file at least annually, and again a few weeks before a major application such as a mortgage or larger personal loan.

- Dispute unfamiliar searches, accounts, or missed payments quickly.

- Make sure your addresses match across your bank, your lenders, and your electoral roll details.

- Limit new applications while disputes are open, so you are not applying with a messy file.

Building a positive credit history

If your file is thin, your main job is to create a track record of on-time repayments without stretching yourself.

Credit-builder credit cards can help, but only if you keep balances low and pay on time. A single missed payment can undo months of careful progress.

Alternatives to Traditional Loans

If a standard bank loan is either unavailable or priced too high, you still have a few routes that can be safer than jumping straight into high-cost credit.

Credit builder credit cards

Credit builder credit cards are designed for people with weaker credit files. Limits are usually low and rates are often high, so they only work if you use them lightly and repay reliably.

- Use the card for a small, predictable spend (for example, fuel or groceries you already budget for).

- Pay in full where you can, or at least pay well above the minimum.

- Keep utilisation low, and avoid cash advances, which can look risky on a credit report.

Borrowing from family or friends

A family loan can be cheaper than commercial lending, but it can also become emotionally expensive if expectations are unclear.

If you go this route, treat it with the same seriousness as a bank loan:

- Write down the amount, repayment dates, and what happens if you are late.

- Use a standing order so repayments are predictable and documented.

- Do not borrow more than you could repay if your income dropped for a month.

Credit unions and other lower-cost options

Credit unions can be a strong alternative for smaller loans, especially if you want a community-focused lender and more human underwriting.

UK regulations cap credit union loan interest at 3% per month (about 42.6% APR), which can be materially cheaper than many “bad credit loan” products once fees and repayment pressure are factored in.

Conclusion

Yes, you can sometimes get a loan with bad credit but high income. The lender will still judge your credit record, and that is why bad credit loans often come with higher rates and stricter terms.

ClearScore acts as a broker, not a lender, and Asda Money’s partnership model can help you check eligibility and compare offers without committing to a full application straight away.

Secured loans, guarantor routes, and bad credit mortgages can all be viable, but you need to match the product to the risk you can genuinely carry.

Fix errors on your credit report, keep repayments on time, and apply only when your file and your affordability story are working together.

FAQs

- Can you get a loan with bad credit but high income?

Yes. Bad credit does not always stop loan approval if your income proves you can repay, but expect higher interest rates and stricter terms.

- Will a high income offset a low credit score?

Often it helps. Lenders weigh income and credit score, and steady income can improve your chances of loan approval.

- What types of loans or lenders should I try?

Look for lenders who specialise in higher-risk cases. Consider loans backed by an asset, or loans that accept a guarantor or co-signer to reduce risk and lower interest rates.

- How can I improve my chance of approval or get a better rate?

Show steady payslips, cut other debts, and add a co-signer if possible. Compare offers from several lenders to find the best interest rate.