Table of Contents

ToggleWhat is the Hang Seng Tech Index?

The Hang Seng Tech Index (HSTECH) is a stock market index that tracks the performance of 30 of the largest technology companies listed on the Hong Kong Stock Exchange. Introduced in 2020, the index aims to capture the growth potential of China’s rapidly expanding tech sector and provide an accessible platform for investors. By including a variety of companies involved in areas like e-commerce, cloud computing, artificial intelligence, and fintech, the index offers a balanced representation of China’s tech industry.

Key Objectives of the Hang Seng Tech Index

The Hang Seng Tech Index was created with several clear objectives:

- Reflect the Tech Landscape: Capture the performance of top tech firms in Hong Kong, many of which have become global competitors.

- Offer Investment Opportunities: Serve as an investment benchmark for investors who wish to access China’s tech growth.

- Showcase Innovation: Highlight the value of companies involved in high-growth sectors like e-commerce, AI, and cloud computing.

The Hang Seng Tech Index is considered unique because it is highly concentrated in high-growth, high-potential tech stocks, setting it apart from more diversified indexes like the Hang Seng Index (HSI), which includes companies from a broader range of industries.

The Components of the Hang Seng Tech Index

The Hang Seng Tech Index comprises 30 companies chosen based on their market value, daily trading volume, and influence within the tech sector. To ensure that it accurately reflects the landscape, the index includes companies from several segments within the tech industry.

Criteria for Inclusion in the Hang Seng Tech Index

To be included in the index, companies must:

- Primarily Engage in Technology: At least 50% of the company’s revenue must be generated from technology-related businesses.

- Have a Strong Market Presence: A substantial market capitalization and high trading volume are required.

- Focus on Innovation: Companies must be involved in innovative sectors such as the internet, cloud computing, e-commerce, or digital services.

Top Companies in the Hang Seng Tech Index

Some of the notable companies that have been part of the Hang Seng Tech Index include:

- Alibaba Group Holding Limited: Known for its e-commerce and cloud computing services.

- Tencent Holdings Limited: One of the world’s largest gaming and social media companies.

- Meituan: China’s leading on-demand services platform, which includes food delivery and travel services.

- JD.com: A major e-commerce company specializing in electronics and household goods.

- Xiaomi Corporation: A leading smartphone manufacturer and consumer electronics provider.

These companies reflect the diversity of China’s tech industry and contribute to the index’s significant volatility and growth potential.

How is the Hang Seng Tech Index Calculated?

The Hang Seng Tech Index uses a free-float-adjusted market capitalization-weighted method to determine the weight of each constituent company. Here’s how it works:

- Market Capitalization: The total market value of each stock is calculated based on its share price and the number of outstanding shares.

- Free Float Adjustment: Only the freely traded shares are included, excluding shares held by insiders or other restricted shares.

- Weight Capping: To avoid excessive concentration, each stock is capped at 8% of the total index weight.

The index is recalculated daily, and constituent adjustments occur quarterly to maintain relevance and reflect the tech market’s latest dynamics.

Key Advantages of Market Capitalization Weighting

The market capitalization weighting method provides several benefits for investors, including:

- Higher Exposure to Leading Firms: Larger companies like Tencent and Alibaba carry more weight, allowing investors to gain significant exposure to market leaders.

- Balanced Risk: Capping ensures that no single company dominates, offering a diversified tech portfolio.

- Growth Reflection: Since the weighting method relies on market value, it reflects the growth in value of tech giants as they expand their market share.

Why Invest in the Hang Seng Tech Index?

The Hang Seng Tech Index has emerged as an attractive investment avenue for various reasons. With its focus on high-growth, innovative tech companies, it represents one of the most dynamic sectors in the global economy. Here are some of the reasons why investors might consider the Hang Seng Tech Index:

Exposure to China’s Growing Tech Sector

China has become a global tech powerhouse, with companies in e-commerce, artificial intelligence, and telecommunications expanding rapidly. The Hang Seng Tech Index provides an efficient way to gain exposure to this growth, as it includes some of the country’s most successful tech enterprises.

Diversification Within the Tech Sector

Investing in individual tech stocks can be risky due to high volatility. The Hang Seng Tech Index reduces some of that risk by offering a diversified tech portfolio within a single investment product. This allows investors to spread risk across multiple companies, from large-cap giants to emerging players.

Long-Term Growth Potential

The companies in the Hang Seng Tech Index are positioned in sectors with substantial growth potential. With continuous advancements in technology and increasing adoption of digital services, companies in the index are likely to see sustained growth, making it an attractive long-term investment.

Strategic Capping for Risk Management

The capping of individual stocks at 8% of the total index weight helps to manage risks associated with over-concentration. This ensures that the index remains diversified while still allowing investors to benefit from the significant growth of leading companies.

Challenges of Investing in the Hang Seng Tech Index

While the Hang Seng Tech Index presents unique opportunities, it is not without risks. Investors should consider the following challenges:

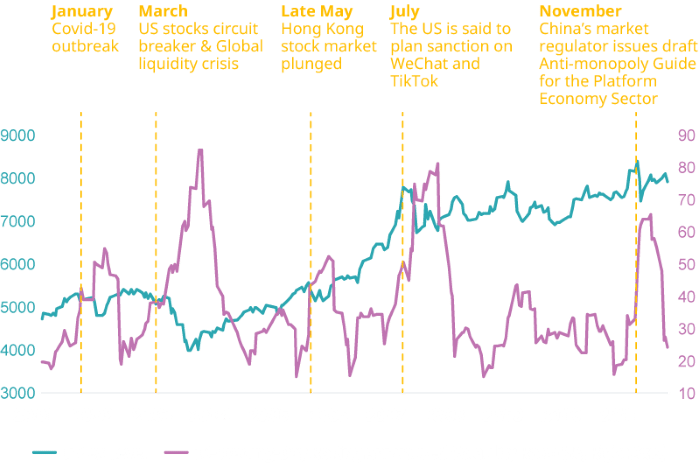

Regulatory Risks

The Chinese government has increasingly tightened regulations on its tech sector, which has led to fluctuations in stock prices for some of the largest companies. Regulations related to data privacy, monopolistic practices, and overseas listings could affect the performance of companies in the index.

Market Volatility

Tech stocks are known for their volatility, and the Hang Seng Tech Index is no exception. Price fluctuations can be drastic, influenced by earnings reports, new tech developments, and global market conditions. Investors need to be prepared for short-term price swings if they invest in the index.

Geopolitical Tensions

Geopolitical tensions, especially between China and the United States, can impact the tech sector. Trade disputes, tariffs, or restrictions on technology transfer could affect the performance of Chinese tech companies, thereby impacting the index.

Currency Fluctuations

Since the Hang Seng Tech Index is based in Hong Kong dollars, currency fluctuations can influence returns for international investors. Changes in the exchange rate between the Hong Kong dollar and investors’ home currencies could impact net returns.

Also Read: James Thomas Cameron

How to Invest in the Hang Seng Tech Index

Investors can access the Hang Seng Tech Index in several ways. Here are the most common investment options:

Exchange-Traded Funds (ETFs)

ETFs that track the Hang Seng Tech Index offer a convenient way to invest in the index. These ETFs replicate the performance of the index by holding the same 30 companies, giving investors direct exposure. ETFs are ideal for investors looking for low-cost entry points and easy diversification.

Mutual Funds

Some mutual funds are designed to track or outperform the Hang Seng Tech Index. These funds may include the index constituents and other companies that meet the fund’s criteria. While mutual funds may have higher fees compared to ETFs, they can offer additional flexibility and active management.

Individual Stocks

For investors looking to pick individual stocks, selecting from the companies in the Hang Seng Tech Index allows targeted exposure to specific tech giants. However, this approach may require more research and is typically less diversified than investing directly in the index.

Derivatives and Futures

Advanced investors may consider options, futures, or other derivative products linked to the Hang Seng Tech Index. These instruments allow investors to leverage positions and potentially maximize returns, though they come with higher risk.

Performance of the Hang Seng Tech Index

Since its inception, the Hang Seng Tech Index has experienced significant volatility, reflecting the highs and lows of the tech market. Its performance is largely tied to the growth of China’s technology industry and global market conditions.

Recent Trends in the Hang Seng Tech Index

- Growth Spurts: The index initially saw rapid growth, thanks to booming demand for digital services during the COVID-19 pandemic.

- Regulatory Impact: Heightened government regulation on tech companies caused declines in some top index constituents, showcasing the impact of policy changes on the index.

- Recovery Trends: Despite regulatory setbacks, the index has shown signs of recovery as companies continue to innovate and expand their services.

The Future of the Hang Seng Tech Index

With China’s commitment to becoming a global leader in technology, the Hang Seng Tech Index has a promising outlook. The increasing adoption of technology across various sectors, from healthcare to finance, offers immense growth potential. However, regulatory stability and geopolitical factors will play crucial roles in determining the index’s trajectory.

Long-Term Prospects for Investors

The Hang Seng Tech Index provides a unique way to access China’s rapidly growing tech sector, which remains highly competitive globally. For long-term investors willing to tolerate some volatility, the Hang Seng Tech Index could be a strong addition to a diversified portfolio. The ongoing digital transformation of the global economy, coupled with rising consumer demand in Asia, is likely to fuel the index’s growth.

The Hang Seng Tech Index has positioned itself as a valuable tool for tracking the tech sector in China. With a focus on leading technology companies, it captures the essence of China’s digital transformation. Investors interested in the high-growth potential of the tech industry, but cautious about overexposure, may find the Hang Seng Tech Index an attractive investment option. As with any investment, it is essential to conduct thorough research, consider the risks, and evaluate one’s financial goals before committing.