Remember that heart-stopping sensation of realising your first paycheck had vanished before the second one would arrive? You’re not alone. For most young adults, financial independence is an accidental destination reached without a roadmap after learning costly and valuable lessons.

Here’s the fact that nobody teaches us how to actually manage money in life. We graduate understanding calculus, but not how to balance a checking account. Until now, that is, with budget tips.

Budget Tips: Your Foundation for Financial Success

There’s one very important first step to financial stability. Budget hacks may not sound sexy, but they’re the difference between living paycheck to paycheck and actually building wealth. Consider budgeting as assigning every dollar a task before it vanishes into the ether of spending spurts and forgotten subscriptions.

Budgeting isn’t always popular with young adults because it feels restrictive. However, the opposite is true. A good budget gives you the freedom to know exactly what you can spend without guilt. Using a budget tracker simplifies this process by automatically categorising expenses and showing where your money actually goes.

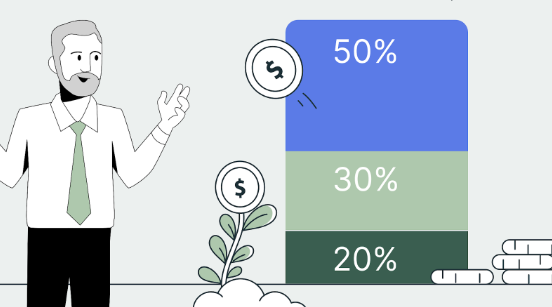

What Is the 50/30/20 Rule of Money?

Need a straightforward system that actually works? Meet the 50/30/20 rule. With this method, your after-tax income is divided into three categories: 50% toward needs, 30% toward wants and 20% toward savings and debt repayment.

Your musts: rent, utilities, groceries, insurance, and minimum loan payments. These are nonnegotiable expenses that, often invisibly, maintain your way of life. Wants are everything else — dining out, streaming services, hobbies and weekend trips. The other 20% sculpts your financial future, via emergency funds, retirement accounts and extra debt payments.

This rule is about balancing flexibility and structure. If you are devoting more than 50% of your income to rent, adjust these percentages temporarily and work toward a better balance. The aim is not to be perfect, just better.

Essential Budget Categories You Cannot Ignore

Creating essential budget categories prevents money from slipping through the cracks. Start with housing, which typically consumes the largest chunk of income. Then add transportation, whether that’s car payments, insurance, gas, or public transit passes.

Food deserves two categories: groceries and dining out. This distinction reveals how much you’re spending on convenience versus cooking at home. Healthcare costs, including insurance premiums and copays, need their own line item because medical expenses always appear at inconvenient times.

Don’t forget the categories people often overlook. Personal care, clothing, subscriptions, and entertainment all need dedicated spaces in your budget. According to Consumer Reports, the average person subscribes to four streaming services without realising they’re spending over $50 monthly.

How to Budget Money When Starting from Scratch

Learning how to budget money feels overwhelming at first. Start by writing down every payment you make in a month, without altering your behaviour. This baseline is the truth of what you spend — and it’s often quite shocking.

Then determine your overall monthly income after taxes. Record all payments from your tracking phase, and give each expense a category. Subtract your costs from your revenue — if you get a negative number, you need to make cuts. If it is a positive one, invest the surplus in financial goals.

Budget Tips for Beginners: Small Changes, Big Impact

Here are some budget tips for beginners that focus more on ingraining sustainable practices than on major overhauls. Begin by automating paycheck transfers to savings. You won’t miss that money when it moves to savings before you even see it.

Eliminate one optional expense this week. Perhaps it’s your overpriced coffee fix or a gym membership you’ve all but abandoned. Small eliminations develop faster than you imagine. That daily $5 coffee adds up to $1,825 a year — money that could go toward an emergency savings account or trip.

Review subscriptions quarterly. You may not be deriving value from services you signed up for six months ago. Cancel anything you haven’t used in 30 days. Also, haggle bills such as internet and insurance annually. Firms frequently discount to retain their customers.

Your Financial Future Starts Today

Mastering money management doesn’t require a finance degree or a six-figure salary. It requires attention, intention, and patience with yourself as you learn. Every financially successful person started exactly where you are now—confused and maybe a little intimidated.

The budget tips shared here provide a starting point, not a rigid rulebook. Adapt them to your situation, experiment with different approaches, and forgive yourself when mistakes happen. Financial literacy is a journey, and you’re already ahead by taking this first step.

What budget tip will you implement this week? Share your experience in the comments below and let us know which strategies have worked best for you!