Five Star Business Finance Ltd., a leading non-banking financial company (NBFC) in India, focuses on micro, small, and medium enterprises (MSMEs), providing accessible financing options to underserved markets. Recognized for its robust customer base and expanding portfolio, Five Star Business Finance stands out in India’s financial landscape for delivering flexible and customized financial products.

The performance of Five Star Business Finance shares on the stock market can be influenced by multiple factors, from market trends to business strategies and regulatory changes. This article explores the Five Star Business Finance share price, offering insights into what drives its fluctuations and what investors should watch for in this financial sector.

Table of Contents

ToggleOverview of Five Star Business Finance Share Price

Stock Market Debut and Initial Share Price

In November 2022, Five Star Business Finance successfully launched its IPO, drawing substantial investor attention due to its solid track record and growth potential in India’s finance sector. The initial public offering (IPO) was priced between INR 450 and INR 474 per share, with a promising outlook that attracted various institutional and retail investors. Since its debut, the stock’s performance has been closely monitored by investors and analysts alike, making the Five Star Business Finance share price an essential barometer for market sentiment towards the NBFC sector in India.

Current Share Price Performance

As of recent trading sessions, the Five Star Business Finance share price has exhibited varying trends, reflecting the company’s response to both internal business developments and external economic pressures. The stock’s price has seen fluctuations as the market adjusts to news and economic data that impacts the lending sector. Tracking these shifts provides insights into how the market perceives Five Star Business Finance’s competitive stance and growth strategy.

Factors Influencing Five Star Business Finance Share Price

The share price of Five Star Business Finance is shaped by a complex interplay of market dynamics, financial performance, sector trends, and investor sentiment. Here are some of the most significant factors that impact its valuation:

Company Performance and Financial Health

- Quarterly and Annual Earnings: The release of quarterly earnings reports is a critical event, as it allows investors to gauge the company’s financial health. Strong revenue growth and consistent profit margins positively influence the share price, while weaker performance could lead to declines.

- Asset Quality and Loan Book: The quality of assets and the health of the loan portfolio are pivotal. Investors look closely at the company’s non-performing assets (NPA) levels, as high NPAs can signify riskier loan practices.

- Cost Efficiency and Profit Margins: The company’s operational efficiency also impacts its bottom line. Maintaining high profit margins through cost-effective processes often supports a positive share price trajectory.

Economic Conditions and Regulatory Environment

- Interest Rate Fluctuations: Since Five Star Business Finance is a lender, interest rate changes, dictated by the Reserve Bank of India (RBI), can significantly impact its profitability. Higher interest rates may restrict borrowing for some clients, potentially slowing the company’s growth.

- Inflation Rates and Market Demand: Rising inflation can increase loan demand as businesses seek liquidity, benefiting Five Star’s business. Conversely, high inflation could also lead to lower loan repayment rates, thus impacting the share price negatively.

- Regulatory Policies: New financial regulations affecting NBFCs, especially regarding risk management and asset quality, can impact the company’s business operations. Policies that make lending easier or protect NBFCs could favorably impact the Five Star share price.

Sector-Specific Trends and Competition

- Growth of MSME Sector: Five Star Business Finance’s focus on financing MSMEs ties its performance to the success of small and medium businesses in India. The healthier this sector, the stronger the company’s loan demand and portfolio growth.

- Competitor Performance: Other NBFCs and banks focusing on MSME financing play a significant role. If competitors innovate faster or offer lower interest rates, Five Star may need to adjust its offerings to maintain market share.

Investor Sentiment and Market Perceptions

- Analyst Ratings and Market Expectations: Analysts’ opinions and ratings on Five Star Business Finance, especially from reputable financial institutions, impact investor perceptions. A “Buy” recommendation from prominent analysts can cause a surge in share price, while downgrades may lead to price drops.

- News and Announcements: Major announcements, like partnerships, expansions, or innovations, can trigger significant share price changes. Additionally, news about the overall economy or financial sector can lead to shifts in investor sentiment.

Analyzing the Five Star Business Finance Share Price: Historical Performance and Future Projections

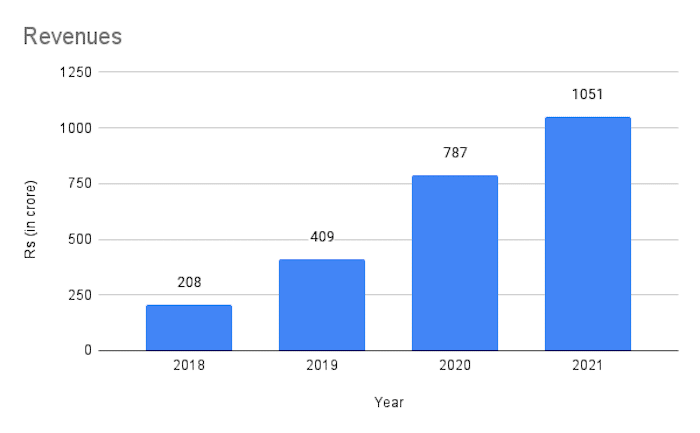

Historical Price Trends: Year-over-Year Analysis

Since its IPO, the Five Star Business Finance share price has experienced both highs and lows, mirroring its performance and broader market movements. Observing year-over-year trends helps investors understand how the stock has reacted to key events and financial reports. Studying these historical data points can guide future investment decisions by offering a benchmark for anticipated movements.

Price Forecasts and Market Outlook

Most financial analysts remain cautiously optimistic about Five Star Business Finance’s future growth due to its niche focus and the growing demand for MSME financing. The expansion of the MSME sector, supported by government initiatives, is expected to drive demand, which in turn could boost the share price over time. However, the impact of regulatory shifts and competitive pressures may temper price growth, making it essential for investors to stay informed on relevant economic policies.

Also Read: Rich Marriott

Key Indicators for Monitoring Five Star Business Finance Share Price

To effectively monitor Five Star Business Finance’s share price, investors should consider a set of key indicators that influence its valuation:

Price-to-Earnings (P/E) Ratio

The P/E ratio is a popular metric used to evaluate a company’s relative valuation. By comparing Five Star Business Finance’s P/E ratio to peers, investors can determine if the stock is overvalued or undervalued. A higher P/E ratio might signal investor confidence, while a lower ratio could indicate market concerns.

Debt-to-Equity (D/E) Ratio

Since NBFCs rely on debt for lending capital, the debt-to-equity ratio provides insights into how leveraged the company is. A high D/E ratio could be a risk if interest rates rise, impacting profitability. Maintaining a balanced D/E ratio helps Five Star Business Finance ensure financial stability, which positively affects investor confidence.

Return on Assets (ROA) and Return on Equity (ROE)

ROA and ROE indicate how efficiently the company uses its assets and equity to generate profits. High ROA and ROE values are usually favorable and can lead to share price appreciation as they reflect strong management and a profitable business model.

Dividend Yield

For long-term investors, dividend yield is an attractive feature, as it provides a steady income in addition to capital appreciation. Although not all NBFCs offer dividends, a competitive yield can make Five Star Business Finance stock more appealing, particularly to income-focused investors.

Pros and Cons of Investing in Five Star Business Finance

Advantages

- Specialized Focus on MSMEs: Five Star Business Finance’s concentrated focus on MSMEs aligns well with India’s growing emphasis on supporting small businesses.

- Resilient Business Model: The company’s strong emphasis on asset quality and prudent lending practices has allowed it to maintain profitability and stability in uncertain markets.

- Growth Opportunities: The MSME financing market remains largely untapped, creating ample room for growth and potential long-term returns.

Disadvantages

- Market and Economic Volatility: The share price may be subject to higher volatility due to economic changes, especially interest rate fluctuations and inflation.

- Competition in NBFC Sector: The highly competitive NBFC sector means Five Star Business Finance must consistently innovate and offer competitive products to maintain market share.

- Regulatory Risks: As financial policies evolve, the company might face regulatory constraints that could impact its lending practices and, subsequently, its profitability.

The Five Star Business Finance share price, shaped by both internal strengths and external market factors, reflects the company’s potential within India’s dynamic NBFC sector. While it has established itself as a reliable player in MSME financing, prospective investors should weigh both the advantages and risks involved. Key considerations include its business model, asset quality, and market position within a competitive industry. Monitoring performance metrics like P/E ratio, D/E ratio, and ROA can help investors make informed decisions.